Be Careful of Mondays.

stand down: phrasal verb of stand 1. relax or cause to relax after a state of readiness.

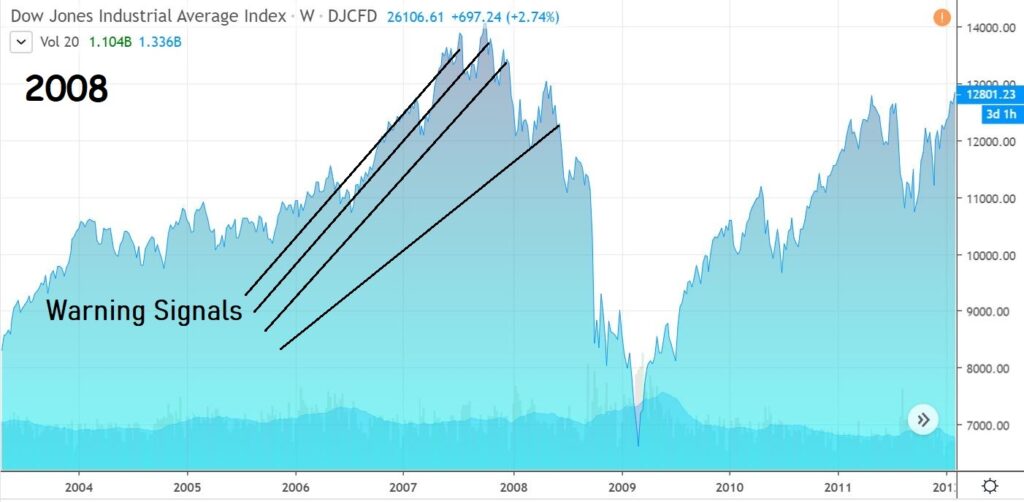

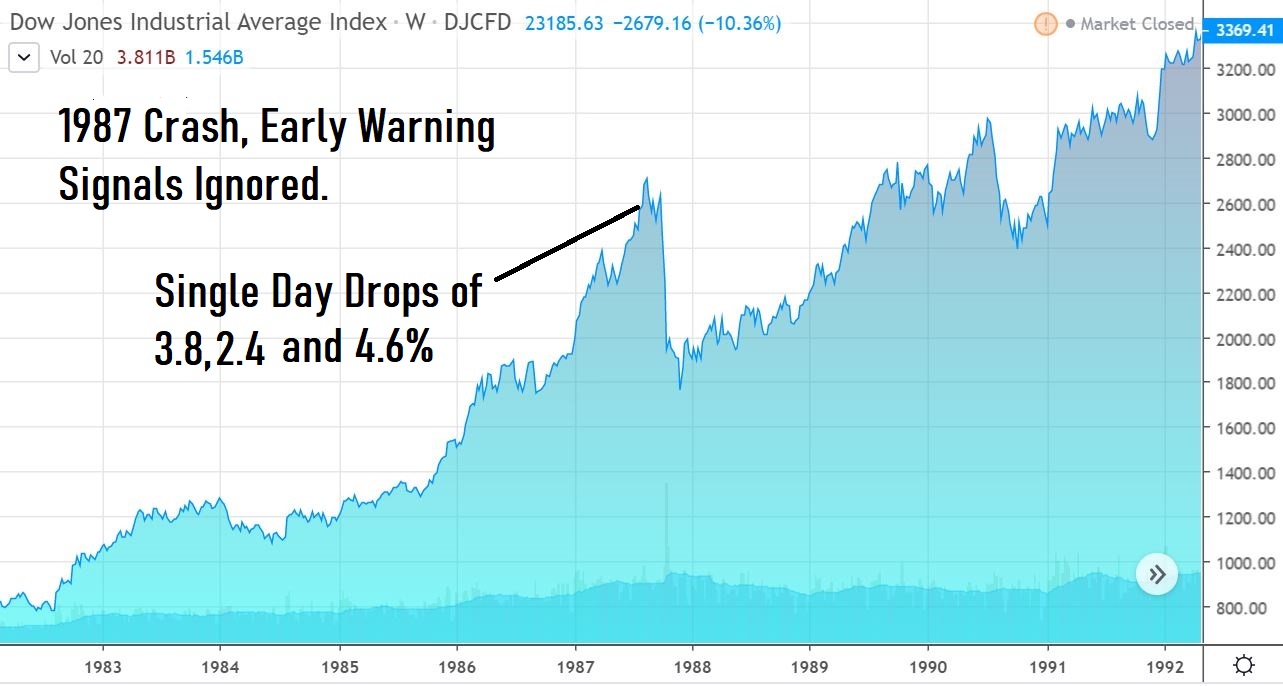

We were working for Drexel Burnham Lambert during the crash of 1987 and a lot of investors have a foggy memory, thinking the drop was all in one day – one and done. In reality, the crash followed a horrifying week which sucked in many bargain hunters right up until the close on Friday.

Here’s a blow by blow.

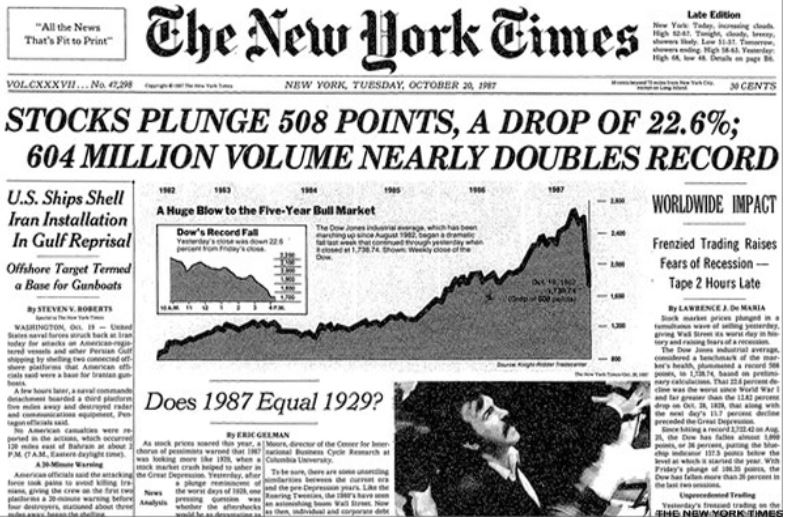

On Wednesday, the DJIA dropped 95.46 points (3.8%) (a then-record) to 2,412.70, and it fell another 58 points (2.4%) the next day, down over 12% from the August 25 all-time high. On Friday, October 16, the DJIA fell 108.35 points (4.6%) to close at 2,246.74 on record volume.

Then Black Monday..

Before the New York Stock Exchange (NYSE) opened on Monday the 19th there was pent-up pressure to sell stocks. When the market opened, a large imbalance immediately arose between the volume of sell orders and buy orders, placing considerable downward pressure on stock prices.

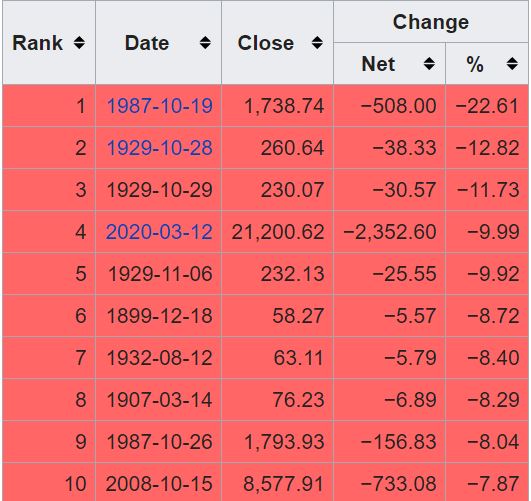

Monday saw the market drop 508 points or 22.8%. From these current levels 22,000 – that would mean a drop of 4,840 points to 17,610.

Could we have another waterfall day like that or even larger? Not likely, but certainly possible, so with large caps – where things won’t quickly ‘get-away,’ we think the best policy is to stand down. No rush to buy.

Maybe there is no meltdown. Maybe there are three or four -5% months instead of 20% in one day. Time will tell.

Some small caps have however taken a royal pummeling and some represent once in a lifetime gifts. More market related than fundamental related – they can return to early January prices and quickly aka: get-away. Nibble or make your list of small caps now.

We think clients Citius Pharma (CTXR) and the Alkaline Water Company (WTER) are both good “get ready to pounce on” examples for investors looking a couple of years out.

“It’s going to be messy because we’ve basically lost all our anchors,” El-Erian said. “We lost the economic anchor with the coronavirus. We’ve lost the policy anchor with people losing confidence in the Fed’s ability to turn things around. And over the weekend, we lost a market anchor with OPEC” failing to get a production-cut deal.

“It means a 20%, 30% drop in prices” from the Dow Jones Industrial Average’s Feb. 12 record, he added. The Dow, as of Friday’s close, was 12.5% off those all-time highs.