Interesting battle brewing!

Inovio shares tumble 8% after short seller Muddy Waters says don’t believe the COVID-19 vaccine hype (MarketWatch).

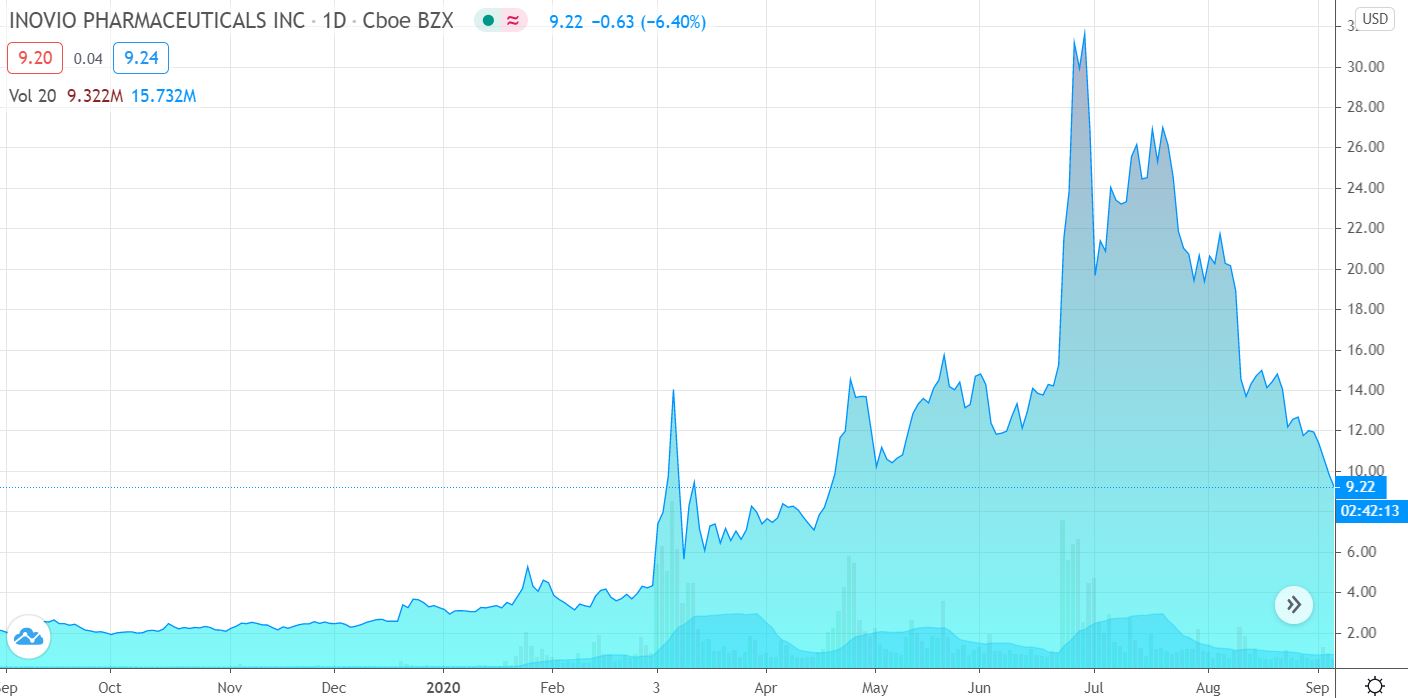

Inovio Pharmaceuticals Inc. shares INO, -6.19% slid 8% Wednesday after Muddy Waters said it has taken a short position in the stock, which has been boosted this year by high hopes for its COVID-19 vaccine candidate. The short-selling firm, led by investor Carson Block, said in a series of tweets that a recent court decision “makes it clear that Inovio lacks manufacturing capacity to get remotely near the purported goal of 1 million doses in 2020 and 100 million in 2021.”

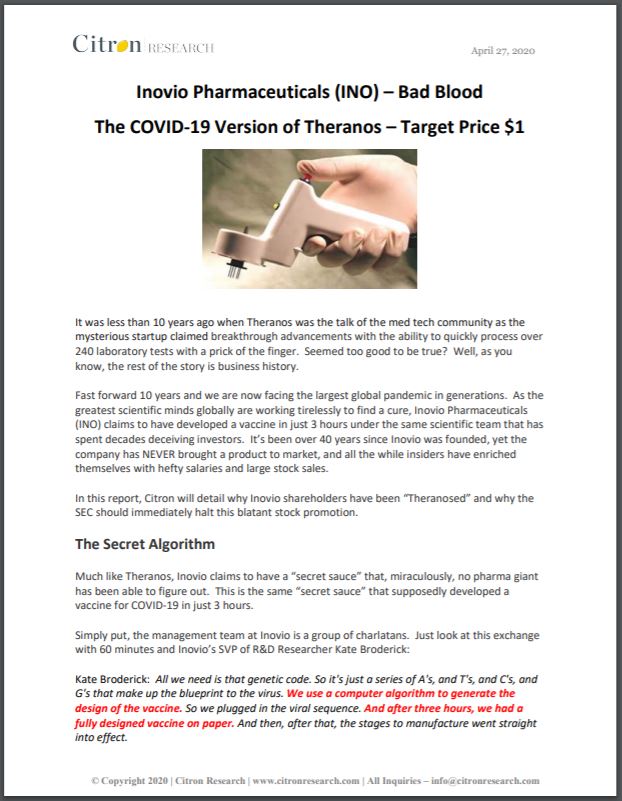

Citron Research Has a $1.00 Price Target

“The darling of finger traders in quarantine.“

The decision was made in a case Inovio brought against GeneOne Life Science Inc. and VGXI Inc. over a supply agreement. Muddy Waters also noted that Citron Research, another short seller, had compared Inovio to scandal-ridden Theranos earlier this year and called it ‘one of the longest-running and most blatant stock promotion schemes ever witnessed.” “We concur,” said Muddy Waters.

Inovio makes DNA based vaccines and immunotherapies for a range of diseases, including HPV and Zika, but hasn’t yet had a product approved for treatment. The company is currently conducting a Phase 1 trial of its vaccine candidate, INO-4800, and has said it expects to start Phase 2/3 trials in September. The company did not immediately respond to a request for comment.

Shares are still up 218% in the year to date.

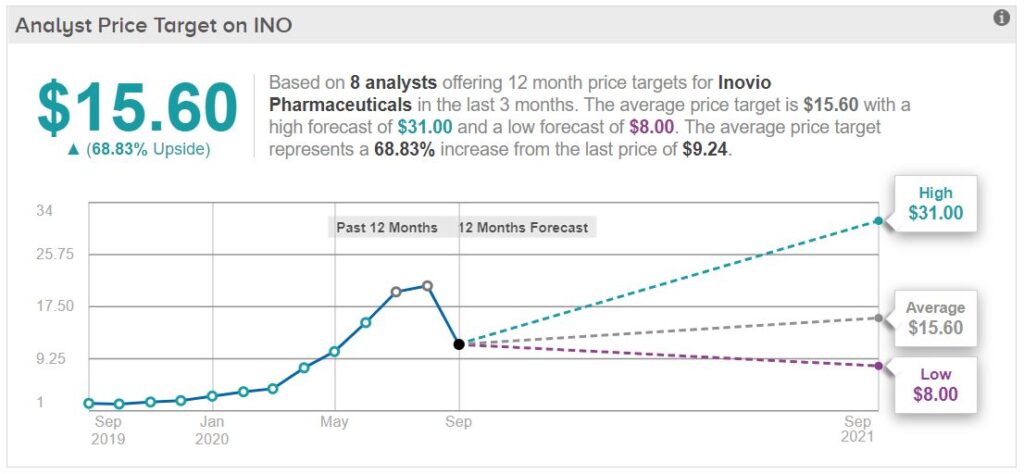

IN THE BULLISH CAMP

(May 20, 2020 on CNBC)

Benchmark analyst Aydin Huseynov had a $36 price target.

Our take? Citron’s one of the best, but Inovio has got an AWFUL lot of money in the bank and could pull an unexpected rabbit out of the hat. Rabbit pulls are the black swans in short-selling.