THE TIKI HUT FUND | TODAY’S BIGGEST MOVERS

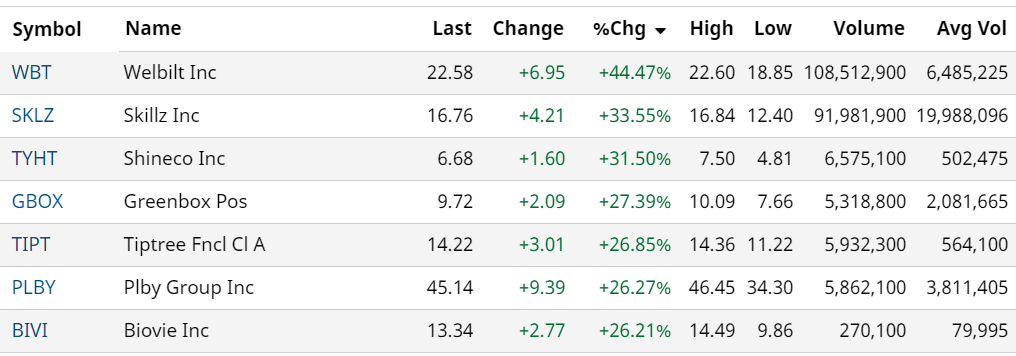

Welbilt Inc. (WBT) $22.58 | Screams Up 44.47%

Welbilt shareholders woke up to a nice surprise yesterday. After a brutal couple of years with the share price plunging from $20 to a pandemic low of $4.00, it’s sayonara. It announced plans to be acquired by larger competitor Middleby (MIDD). Investors think the combination that will create a kitchen equipment supply leader in the commercial foodservice space is a good one for shareholders of both companies. News

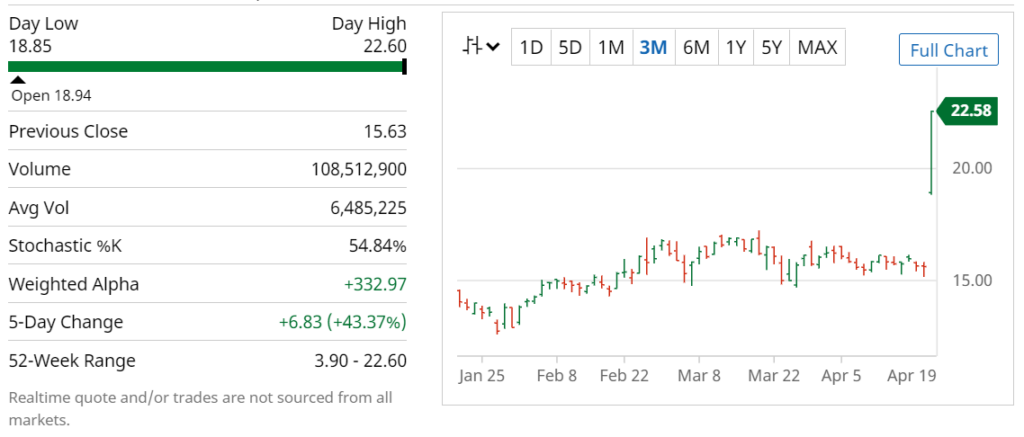

Skillz Inc. (SKLZ) $16.76 | Pops Up Higher 33%

For the love of God, pull up! Skillz finally bounced after being in a horrific death spiral for the last 3 months falling from $44 to $12. They sold 32 million shares last month at $24 with Citigroup, Goldman Sachs handling the offering (thanks for the stock tip guys). Skillz is the leading mobile games platform. The Skillz platform helps developers build multi-million dollar franchises by enabling social competition in their games. Leveraging its patented technology, Skillz hosts billions of casual esports tournaments for millions of mobile players worldwide and distributes millions in prizes each month. Skillz has earned recognition as one of Fast Company’s Most Innovative Companies, CNBC’s Disruptor 50, Forbes’ Next Billion-Dollar Startups, and the #1 fastest-growing company in America on the Inc. 5000. So is the start of a rebound? News

CB Scientific (CBSC) $0.83: My-Cam™ and My-Cardia™ the Ultimate ‘Any-Doctor-Anywhere’ Telehealth Monitoring Application.

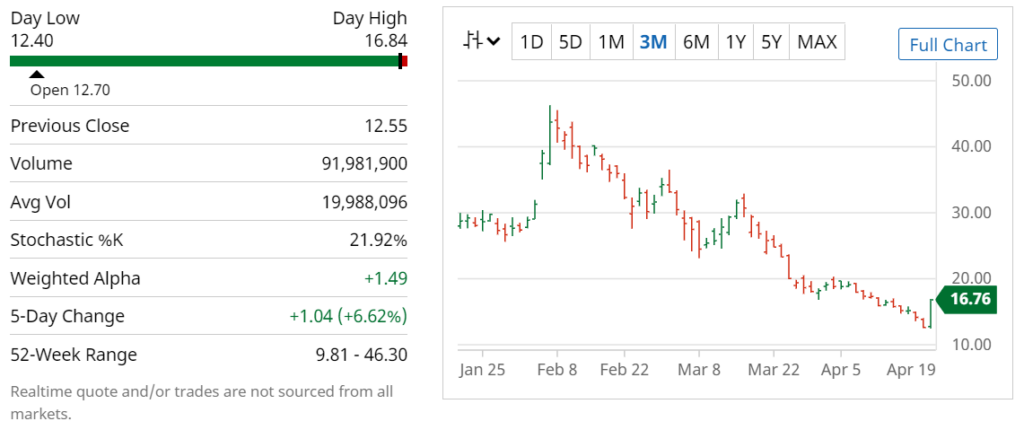

Shineco Inc. (THYT) $6.68 | Rebounds Up 31.50%

A left and a right and another left – Shineco was looking like it was down for the count. last fall, falling from the equivalent of $100 a share back in 2017. 9:1 reverse split on August 17th, sometimes reverse splits work – post reverse. Headquartered in Beijing, China, Shineco is a holding company. Through its subsidiaries and variable interest entities, Shineco undertakes vertically- and horizontally-integrated production, distribution, and sales channels to provide health and well-being focused plant-based products in China. Ah, no thanks, lol. News

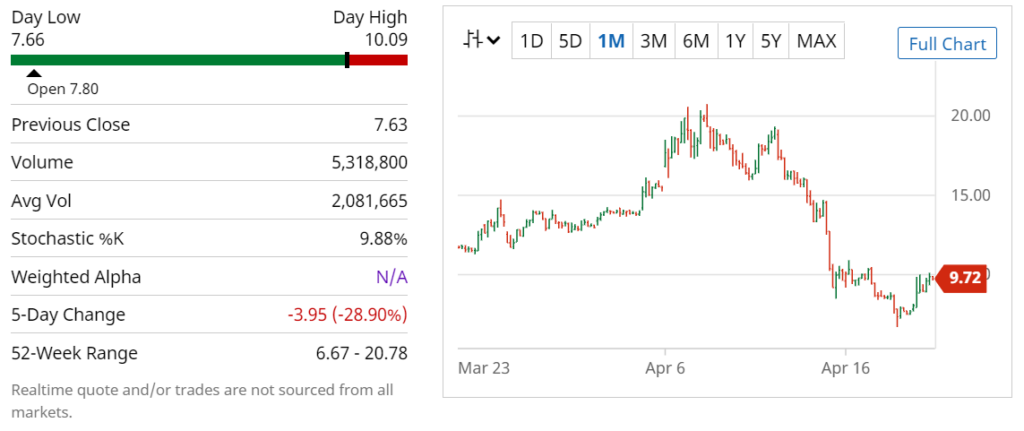

GreenBox POS (GBOX) $9.72 | Bounces 27% Higher

Now, this is an interesting one. Greenbox is a bitcoin/blockchain/fintech play. Is it trading down in sympathy with bitcoin? Kinda, sorta. They expect to process $1.2 billion in payments in 2021, or twice as much as GreenBox’s initial outlook of $600 million. Payment processing volumes in the first quarter have been much higher than expected, leading to the increased forecast for the year. The higher volumes should also pave the way for improved operating margins and new smart-contract token volume, according to GreenBox. So there ya have it. News

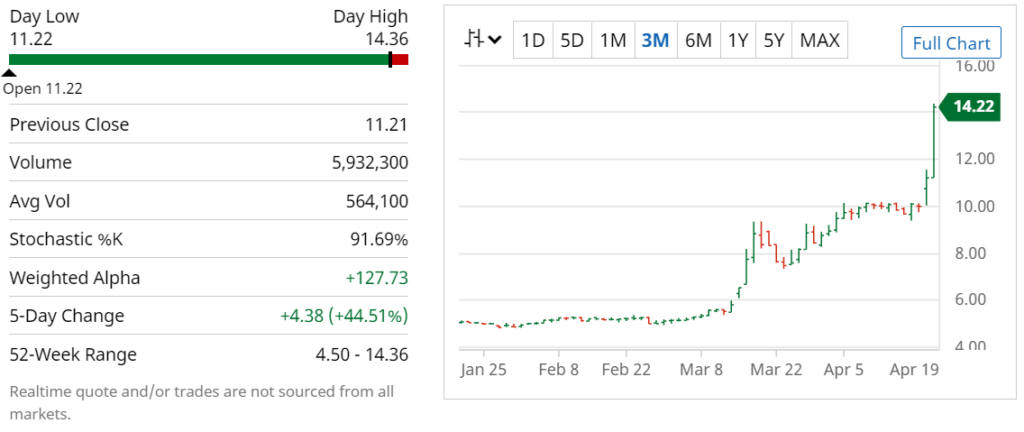

Tiptree Inc. (TIPT) $14.20| Freight Train Move Up Another 26%

Dayam – up a powerful 3-fold since March, Tiptree Inc. is a holding company that allocates capital across a broad spectrum of businesses, assets, and other investments. Principal operating business, Fortegra, is a specialty insurance program underwriter and service provider, which focuses on niche business lines and fee-oriented services. They also allocate capital to a diverse group of select investments that they refer to as Tiptree Capital. Play might be the proposed Initial Public Offering of Fortegra. News.

SinoFresh: One-Stop E-Commerce OTC Health & Wellness Pharmacy

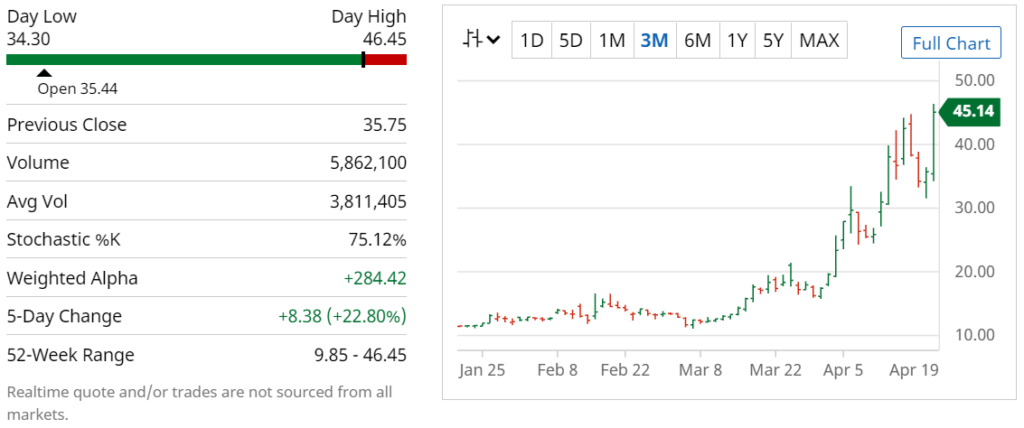

PLBY Group, Inc. (PLBY) | $45 Jumps 26%

Can’t hold a good bunny down, Playboy again hits our daily biggest gainer list. No pun intended, but this one has legs. Numbers have been fantastic – and it doesn’t hurt the daytraders all know the name. Playboy serves consumers in four major categories: Sexual Wellness, Style & Apparel, Gaming & Lifestyle, and Beauty & Grooming. First-quarter numbers out in early May. News.

BioVie Inc. (BIBI) $13.34 | Bounces Higher 26%

It’s been a brutal 2021 for BioVie, but every dog has its day! A cirrhosis play, they raised $15 million at $10 last September and uplisted to NASDAQ. It then screamed running to a high of $44 in six weeks. It was a thing of beauty. And then not so beautiful – retracing back to $10 a few weeks ago. Maybe investors didn’t like the idea of them filing a $100 million mixed shelf offering. In January, B Riley had a $47 target. We’re studying this one. Interview

Dalrada Corp (DFCO): Dalrada (DFCO) Records First Sales of LikidoVOLT® Independent Power Generators With Hidden Villa Ranch