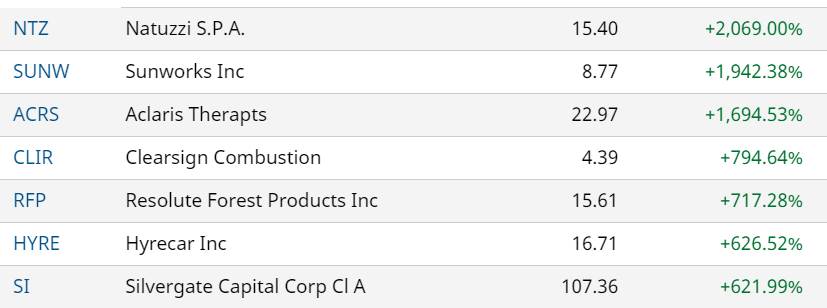

THE TIKI HUT FUND |THE PAST YEAR, BIGGEST MOVERS

AVERAGE GAIN 1,209%

Natuzzi S.P.A. (NTZ) | The GameStop Of Furniture up Over 2,000%!

No folks, there is no explaining this. Corona proof couches maybe? Sales down each and every year four years running including -15% last year. The stock was $0.50 last summer. Makes us dizzy in confusion, yet optimistic that anything can happen in this market.

Sunworks Inc (SUNW) | Solar Play Shining Bright up 1,900% in Past Year

Okay, we get this. Alternative energy. Truth be told they’ve had a difficult decade – as it was trading in the $20’s in 2015 (reverse split basis), so this is a turnaround situation. At one point it was up 4,000% in January when it was trading at near $20. It may have bottomed here and we will be studying it. This would fall under “Joe Biden, green-energy play.” The market cap was near $500 million, now near $200 million with near $40 million in the bank and a near $40 million backlog. Hmm. NEWS

Aclaris Therap (ACRS) | Plenty of Action in the Pipeline up 1,600% on Good Data

Another turnaround situation, Alclaris was in a death spiral falling from $30 in 2017 to $0.30 last year. This is one of the things we like about broken down biotechs. When they recover, they recover good. The pipeline is too long to list, Aclaris raised $103 million on good early trial data. Worth studying. NEWS.

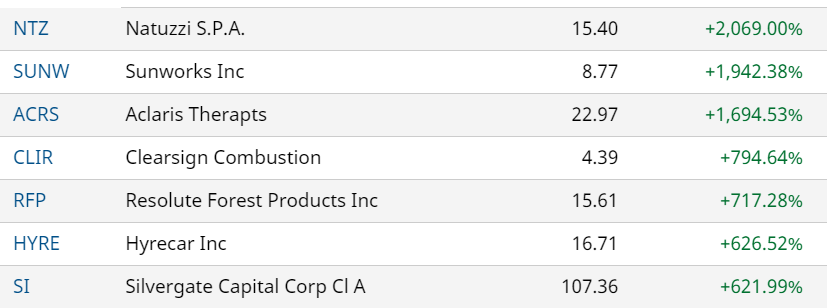

APHEX BioCleanse Systems (SNST) | The World’s Best Industrial Sanitizer?

Very interesting. Not officially on the above list, but a very pretty chart nonetheless. A client, Aphex reverse merged into Sunset Capital last year and their industrial OEM sanitizer has been getting rave reviews throughout the industry.

Their proprietary Hy-IQ® Water products have an incredibly unique and strong set of relevant attributes, including alcohol-free, non-toxic, non-flammable, non-irritating, hypo-allergenic, and safe for children and pets. It’s sanitation uncompromised and in our opinion, a paradigm shift away from alcohol which is probably 90% of the market. NEWS ARCHIVE. If they get FDA approval, it’s game-over for alcohol (says we..just saying).

RELATED: Adding Aphex BioCleanse Systems (SNST) to CoronaVirus Watch List.

Clearsign Combustion (CLIR) | Is it Finally the Time to Own Clearsign?

We’ve been watching this go down every year for nearly 8 years, always wondering if “now is the time.” Falling from $13 shortly after going public – this has Gamestop-type qualities. OEM products as ClearSign Core™, and ClearSign Eye™ and other sensing configurations, that enhance the performance of combustion systems and fuel safety systems in a broad range of markets, including the energy (upstream oil production and down-stream refining), commercial/industrial boiler, chemical, petrochemical, transport and power industries. Now that the ‘fever’ has finally broken it could go ballistic. We’ll study. NEWS

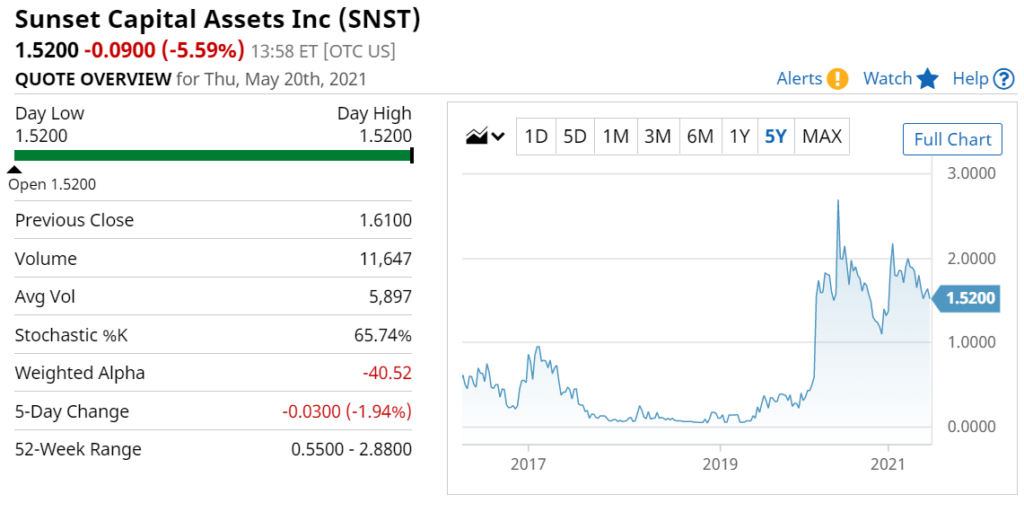

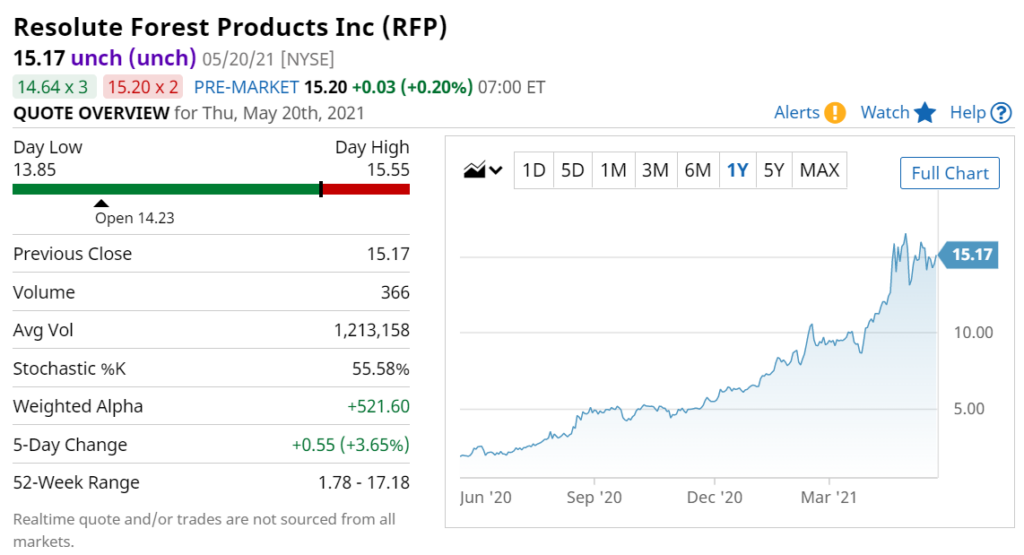

Resolute Forest Products Inc (RFP) | This Chart Gives us Wood!

How effen sweet and good for shareholders. Wood makes America Great Again – despite China’s 25% tariffs on lumber, which used to account for about half of all U.S. hardwood lumber exports. Share price rose from $1.00 to $15 or $10,000 to $150,000. Let’s build a white picket fence while drinking pitchers of Vodka and Lemonade to celebrate. Resolute Forest based in Montreal, together with its subsidiaries, operates in the forest products industry in the United States, Canada, Mexico, and internationally. Moral of the story, if you’re bullish on housing, don’t buy a house. Buy a housing-related stock. Do you know of any homes which rose from $1 million to $15 million in the last twelve months — exactly. Forget real estate. NEWS.

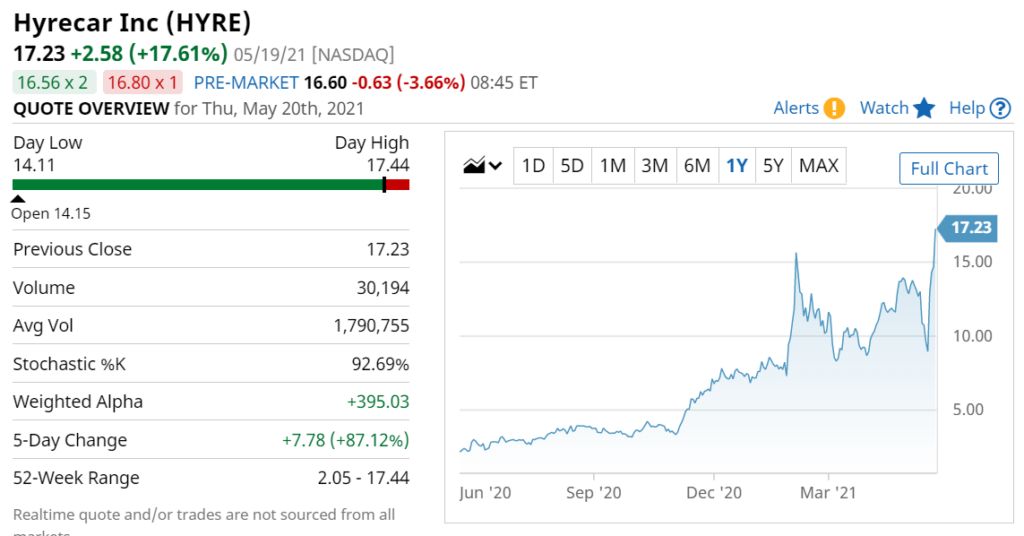

Hyrecar Inc (HYRE) | A Value Play?

HyreCar is a carsharing marketplace for ridesharing that allows car owners to rent their idle assets to rideshare drivers INCLUDING to rideshare companies like Uber and Lyft and food delivery. HyreCar also provides insurance. Hmm. Where could this be in five years? It has Wall Street support: TipRanks.

Investors panicked about a lack of cars available during 2019, and the share price drifted from $7.55 to $0.92. It bottomed in April of 2020. A ‘ride-sharing’ play, investors started warming up to the idea, not as they made more and more money, but rather when they lost less and less money. Hyrecar is expected to post a quarterly loss of $0.12 per share in its upcoming quarter, which represents a year-over-year change of +45.5%. Revenues are expected to be $9.11 million, up 63.3% from the year-ago quarter.

Not cheap with a market cap of $300+ million, but this has ‘you never know’ potential and $25 million in the bank end of March. In the most recent quarter, commercial bookings represented more than 60% of all cars rented on the platform, new drivers in the first quarter of 2021 were up 14.0% year over year. Webcast.

Silvergate Capital (SI) | Digital Currency Play

A Bitcoin sympathy play. SilverGate’s real-time payments platform, known as the Silvergate Exchange Network, is at the heart of its customer-centric suite of payments, lending and funding solutions. We still prefer Galaxy Digital (BRPHF) as a sympathy play which we added to the Watch List at $5.00 in November.

AS COMPARED TO BITCOIN