Interesting viewpoints ahead of the market drifting from near 12,000 to 7,000. Equivalent to Dow dropping to near 20,000 today.

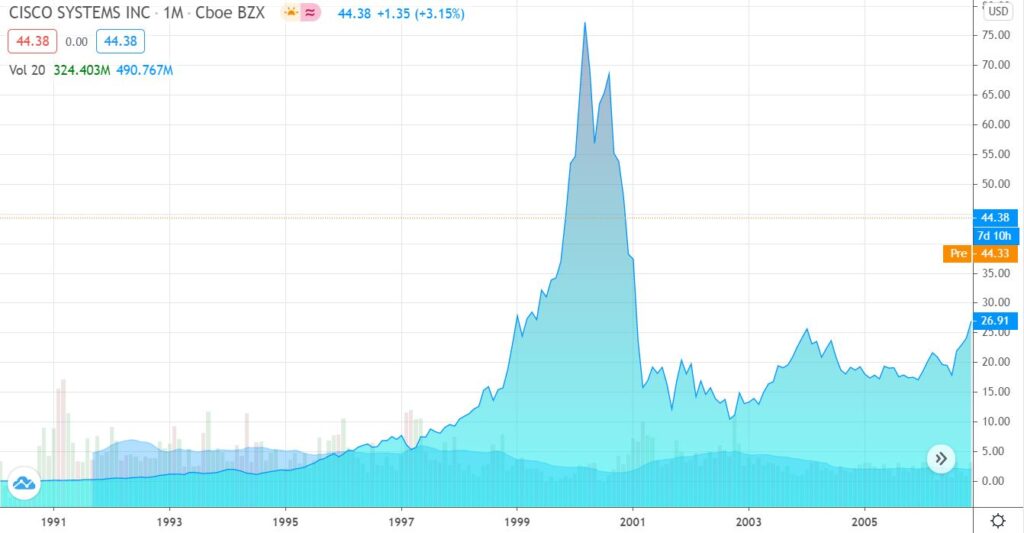

CISCO

Excerpt:

Barton Biggs: It’s not P/E ratios anymore. It’s price to sales.

Abby Cohen: I think you can apply a standard valuation metric to the technology companies in the S&P 500 and conclude that they’re not overvalued even at today’s prices.

Scott Black: I have a list. Cisco, 83 times expected earnings. Sun Microsystems, 72 times expected earnings. Dell, 51 times. EMC, 66 times forward earnings. How do you figure they’re not grossly overvalued relative to their growth rates?

John Neff: Cisco trades for 105 times earnings. The stock is 105, and the company’s going to earn $1 in its current fiscal year.

Abby Cohen: Let me examine this from a strategist’s standpoint rather than that of a bottom-up analyst, because I’m not an analyst of any of these stocks. When we look at these stocks as part of a group and apply a dividend-discount-model methodology, or even an EVA-type methodology, we conclude that yes, they are selling at above-average P/Es or other ratios. But the companies’ underlying corporate performance warrants it.