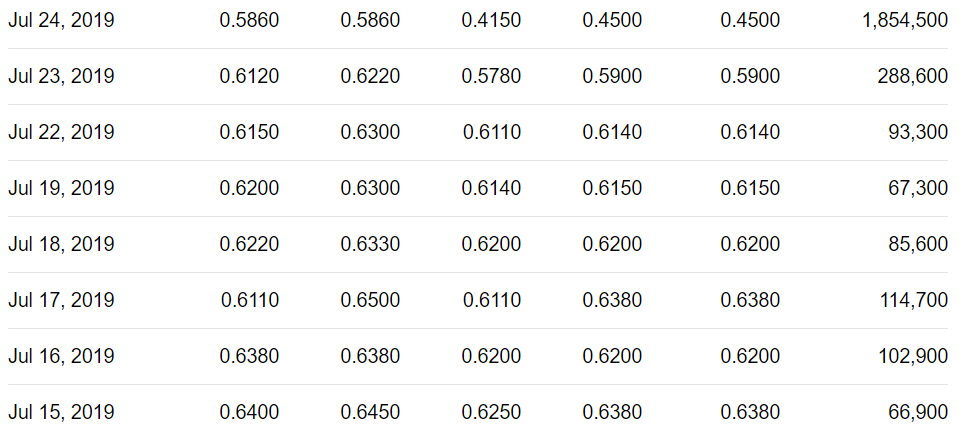

Short Term Turbulence Creates Potential Entry Point at $0.45.

Investors appeared to react swiftly to an 8K, which looked a lot like they were facing immediate de-listing from NASDAQ, for having the share price under $1.00 for an extended period of time.

The first 8K went out Jan 25th, 2019 stated “The Notification Letter provides that the Company has 180 calendar days, or until July 22, 2019, to regain compliance with Nasdaq Listing Rule 5550(a)(2). To regain compliance, the bid price of the Company’s common stock must have a closing bid price of at least $1.00 per share for a minimum of 10 consecutive business days. If the Company does not regain compliance by July 22, 2019, an additional 180 days may be granted to regain compliance, so long as the Company meets the Nasdaq Capital Market continued listing requirements (except for the bid price requirement) and notifies Nasdaq in writing of its intention to cure the deficiency during the second compliance period.

The second 8K went out on July 23rd, offered much less detail and hence, looked more ominous. “The Company did not regain compliance with the Rule by July 22, 2019 and, as a result, on July 23, 2019, the Company received notice from the Staff that, based upon the Company’s continued non-compliance with the Rule, the Staff had determined to delist the Company’s common stock from Nasdaq unless the Company timely requests a hearing before the Nasdaq Hearings Panel (the “Panel”). The Company intends to timely request a hearing before the Panel, which request will stay any delisting action by the Staff at least pending the issuance of the Panel’s decision following the hearing and the ultimate conclusion of the hearing process. At the hearing, the Company will present its plan to regain compliance with the Rule and request an extension of time within which to do so.”

We recommend investors read both 8K’s to form their own opinion in addition to talking to a qualified financial advisor for their interpretation.

In our opinion, the briefer filing lead investors to focus on ‘determined’ to delist and not see ‘unless’ (including verbiage ‘a reverse stock split’) which spooked investors who decided to shoot first and ask questions later.

While we have been following the company for a year, and in general feel it appears to be undervalued in relation to its potential, we are just now digging into all of its SEC filings and press releases.

Additions to our various Watch Lists are not ‘buy recommendations’ – but simply a notification to our subscribers that something interesting is afoot, and should be studied and/or monitored.

We have additionally contacted the company with regards to providing ongoing coverage for the company via Institutional Analyst Inc., (an Investor Relations firm) and the Internet Stock Review.

Open Price $0.58. Low Price $0.41. Closing price, $0.45.

Investors can expect continued volatility during the process of regaining compliance for a continued listing on NASDAQ. At the same, for institutional investors who are looking to establish a significant position in the companies shares, the expected increase in volume may provide such an opportunity – which prior to the current turbulence – had an average daily volume which was prohibitively low to do so.

February Corporate Presentation

DISCLAIMER

Institutional Analyst Inc. and Revelers.IO Media Group Inc., Disclaimers: Past performance of other companies added to Institutional Analyst’s various newsletters or otherwise mentioned in its research reports, newsletters or communication is no indication of future performance of any current or future companies mentioned. This publication is a Corporate Profile and may not be construed as investment advice. This profile does not provide an analysis of the Company’s financial position and is not a solicitation to purchase or sell securities of the Company. Readers should consult their own financial advisors with respect to investment in this or any company covered by the Reviews. An independent financial analyst should verify all of the information contained in this profile with the profiled company. Institutional Analyst, Inc. the parent company of the Internet Stock Review report is an investment research and public relations firm and associated firms have not been compensated from the Company for ongoing progress reporting, but may be engaged in the future. Revelers.IO Media Group Inc. is a web design firm which manages IA’s websites and digital initiatives. In preparing this profile, the Publisher has relied upon information released from the company, which although believed to be reliable, cannot be guaranteed. This profile is not an endorsement of the shares of the company by the publisher. The publisher is not responsible for any claims made by the company. You should independently investigate and fully understand all risks before investing in this and any company profiled or covered by the publisher. The majority of startup companies have factors, which create uncertainty about their ability to continue as a going concern. These concerns are typically related to dilutive toxic financing (or lack of), competitive environments, lack of operating history and operating at loss levels which is typical of most start-ups. These statements can be found in their most recent 10Q filings and should most definitely be read. Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: The statements which are not historical facts contained in this profile are forward-looking statements that involve certain risks and uncertainties including but not limited to risks associated with the uncertainty of future financial results, additional financing requirements, development of new products or services, government approval processes, the impact of competitive products or pricing, technological changes, the effect of economic conditions and other uncertainties detailed in the Company’s filings with the Securities and Exchange Commission. Impartial, we are not. Email: [email protected]