Important to note, the FDA didn’t approve the price, they approved the drug. It was priced afterwards. Second item it is a one-time treatment.

FDA approves most expensive drug ever, a $3.5 million-per-dose gene therapy for hemophilia B (CBSNews).

Washington — U.S. health regulators on Tuesday approved the first gene therapy for hemophilia, a $3.5 million one-time treatment for the blood-clotting disorder. The Food and Drug Administration cleared Hemgenix, an IV treatment for adults with hemophilia B, the less common form of the genetic disorder which primarily affects men.

Currently, patients receive frequent, expensive IVs of a protein that helps blood clot and prevent bleeding.

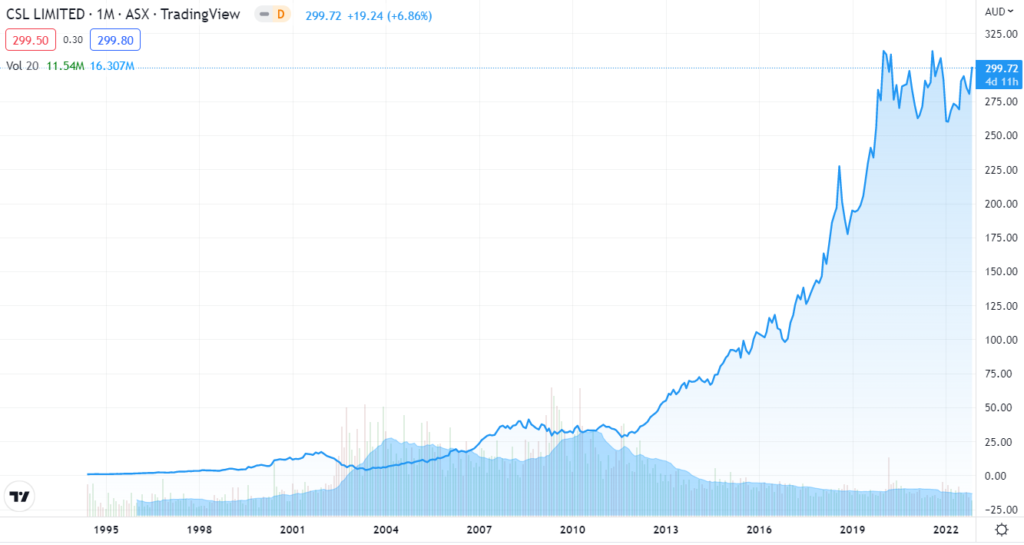

Drugmaker CSL Behring (CSL.AX), based in Pennsylvania, announced the $3.5 million price tag shortly after the FDA approval, saying its drug would ultimately reduce health care costs because patients would have fewer bleeding incidents and need fewer clotting treatments.

NOTE: CSL Behring will commercialize the gene therapy, but uniQure (QURE) will manufacture it. It has already received $500 million in milestone payments from CSL and will receive up to $1.5 billion more in milestone payments for the drug’s approval, along with tiered, double-digit royalties on revenue derived from the therapy.

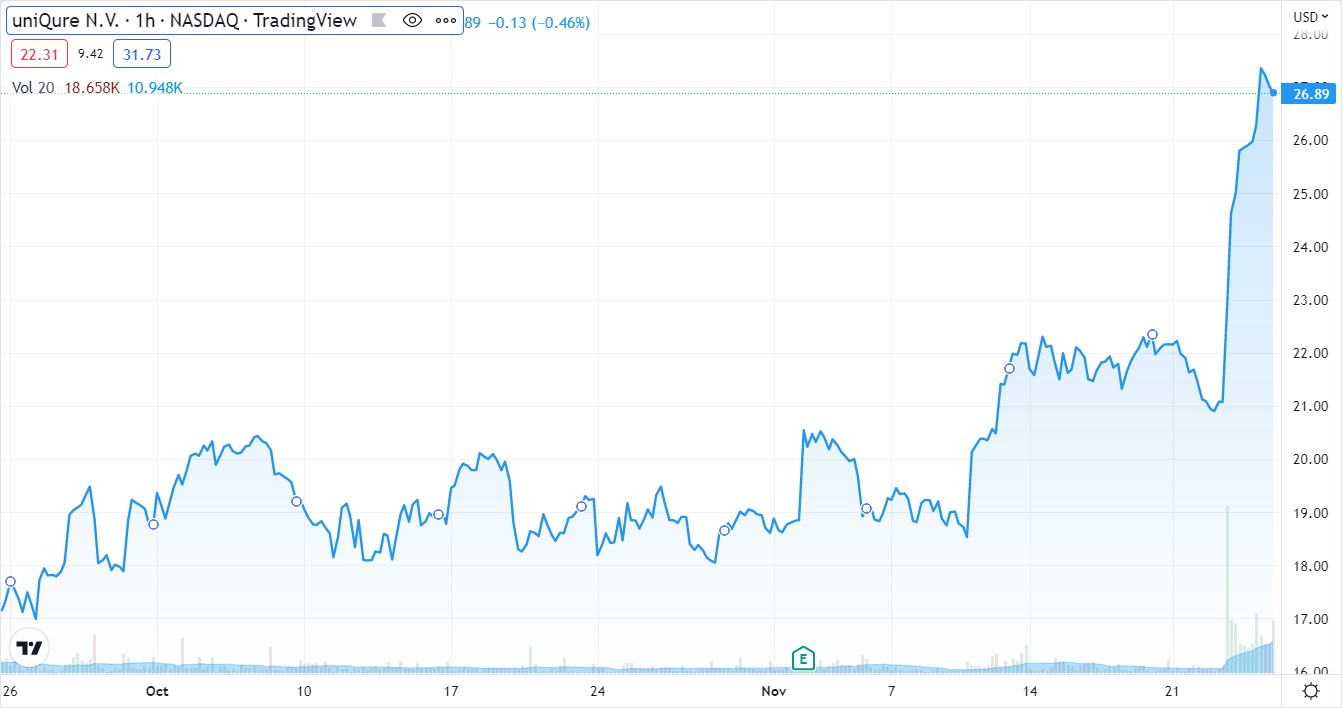

CSL made little movement (see below), while uniQure popped 15%.

The U.S. Centers for Disease Control and Prevention statistics show hemophilia affects roughly 1 in 5,000 births, but only a quarter of those are born with Hemophilia B.

Market cap is $1.2 billion, we’ll pass for now – just don’t have time and you can’t kiss all the pretty girls..

Today’s lesson, as we have said many, many times before. Price performance prior to approval (up or down), is often of little use — with regards to approval odds making. As in if a stock is down 60%, thinking no way it gets approved, or it’s up 60% thinking approval is in the bag.

uniQure dropped 65% this year falling from $38 to $13 as “experts, analysts and those in the know” relentless sold.

We can guess they were predicting or projecting NO APPROVAL.

In the third quarter, the uniQure’s revenues were $1.4 million, down from $2 million in the same period a year ago. The company also lost $47.9 million, or $1.02 in earnings per share (EPS), compared to a loss of $36.5 million, or an EPS loss of $0.79 in the third quarter of 2021.

The approval gives credence to the other gene therapies in its pipeline. Wall Street gives the approval an extra, extra dose of credence!

RELATED: The FDA Just Approved Its Most Expensive Drug Ever — Sending UniQure Stock On A Warpath Investor’s Business Daily