David Hunter, chief macro strategist at Contrarian Macro Advisors.

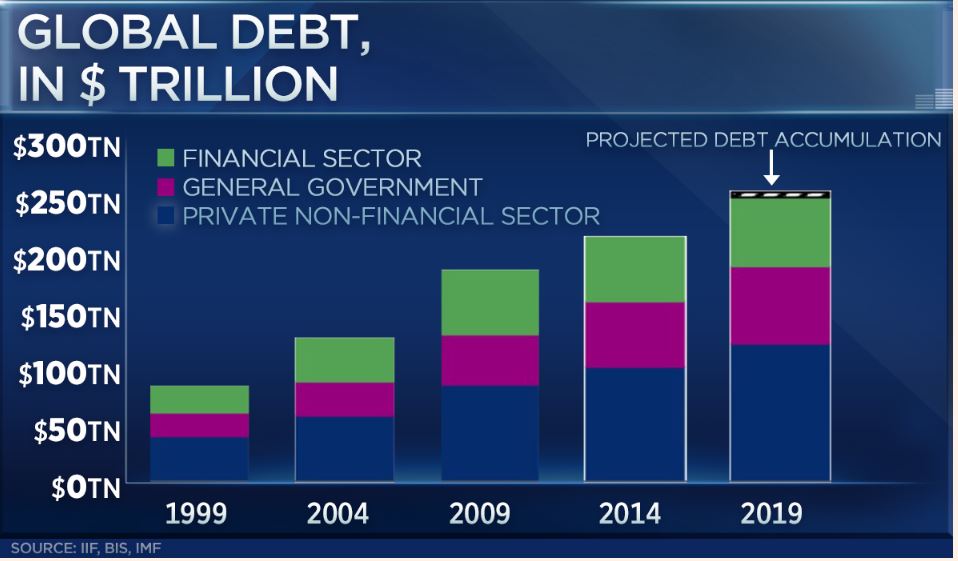

Interesting interview with David Hunter, who predicts some awful things ahead (-80% market dip). But FIRST, a market which can further inflate in a big way. He also thinks global debt can spike to $375 trillion up from $250 trillion. After the next bust (business closures bust), and up to the end of this decade – most likely in response to the bust.

Remember global debt doubled from $100 trillion in 2000 to $250 trillion today, so what’s another 50% bump higher gonna do, right?

Like a stock going from $10 to $25 and then to $35.

DEFLATION AHEAD?

He expects disinflation (low and lower inflation) to turn into deflation (huge minus 3-5%) after the next dip in the economy next year, which very few analysts are calling for. this is before he sees the ’70s type inflation – in two or three years.

Sit back and let that sink in.

We were selling municipal bonds at Drexel Burnham Lambert yielding 12% in the early ’80s. So we remember and loved inflation. Back then a 5% commission didn’t affect yield much! Yup, different times! Where’s all the muni-bond customers Yachts.

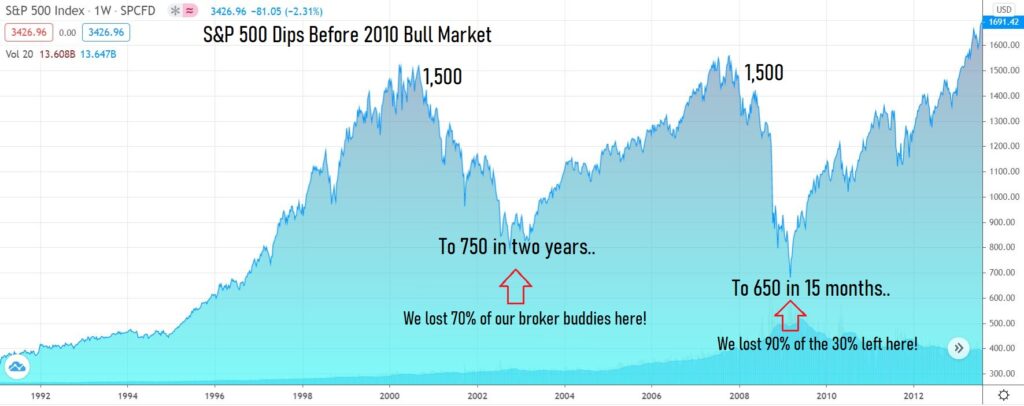

Hunter also says forget the “retest narrative” being touted by many Wall Street strategists. Instead, “It will be ‘a bear market of historic proportions,’ culminating with the S&P 500 around 800. Basically the biggest bear market since the ‘29 crash. And this unwind could happen quickly. Faster than what we saw in 2008/9. We can go from peak to trough in less than six months.”

RECENT UNWINDS

How do you play predictions like that?

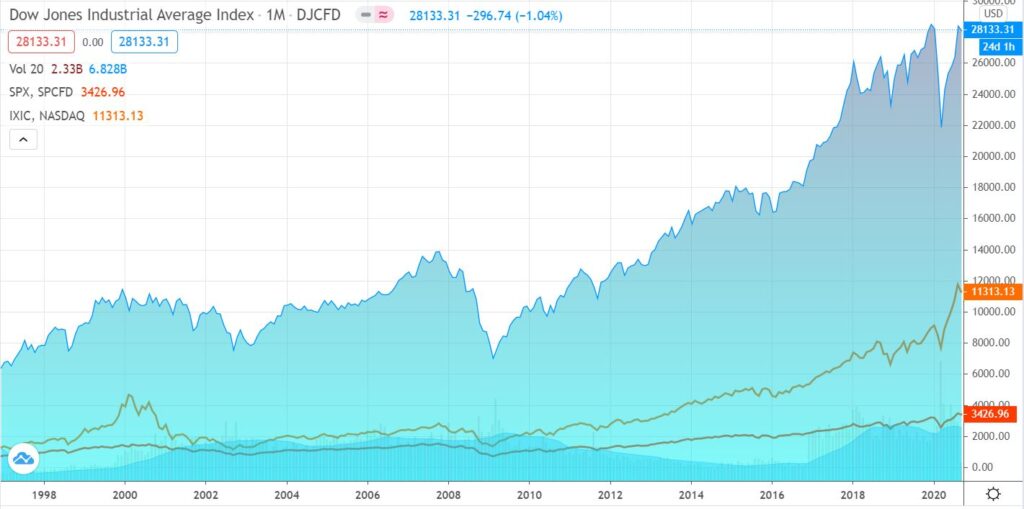

Not a perma-bear, Hunter does believe there will be a recovery, after the bust. He also mentions for the balance of the decade that ‘the metals’ will probably be the dotcoms of the ’90s (12:00 mark) so getting in during 2021 or 2022 and holding to 2027 or 2028 may be the way to go. The trade of the decade.

Bookmark: Institutional Gold Research

(More specific forecasting on gold going to $2,300 and then retreating back to $1,800 along with the stock market drop, before a decade long run to $10,000 can be found at 49 minute mark.

Finally, contrary to most analysts think the Dollar, after dropping to $85 from $93 currently, could ratchet to $140 during the bust. Just saying.

We are not investment advisors and we are not traders. Meaning we are not giving advice. But we would suggest to friends and family is not try to grab the top tick in equities as it rises in front of your eyes. And not try to sidestep a correction in gold as it falls in front of your eyes, assuming it’s headed to $10,000 by the end of the decade. Just get out of stocks now (except our favorites) and get in gold now and hold on for dear life. It’s going to be a crazy 2021. Be prepared.

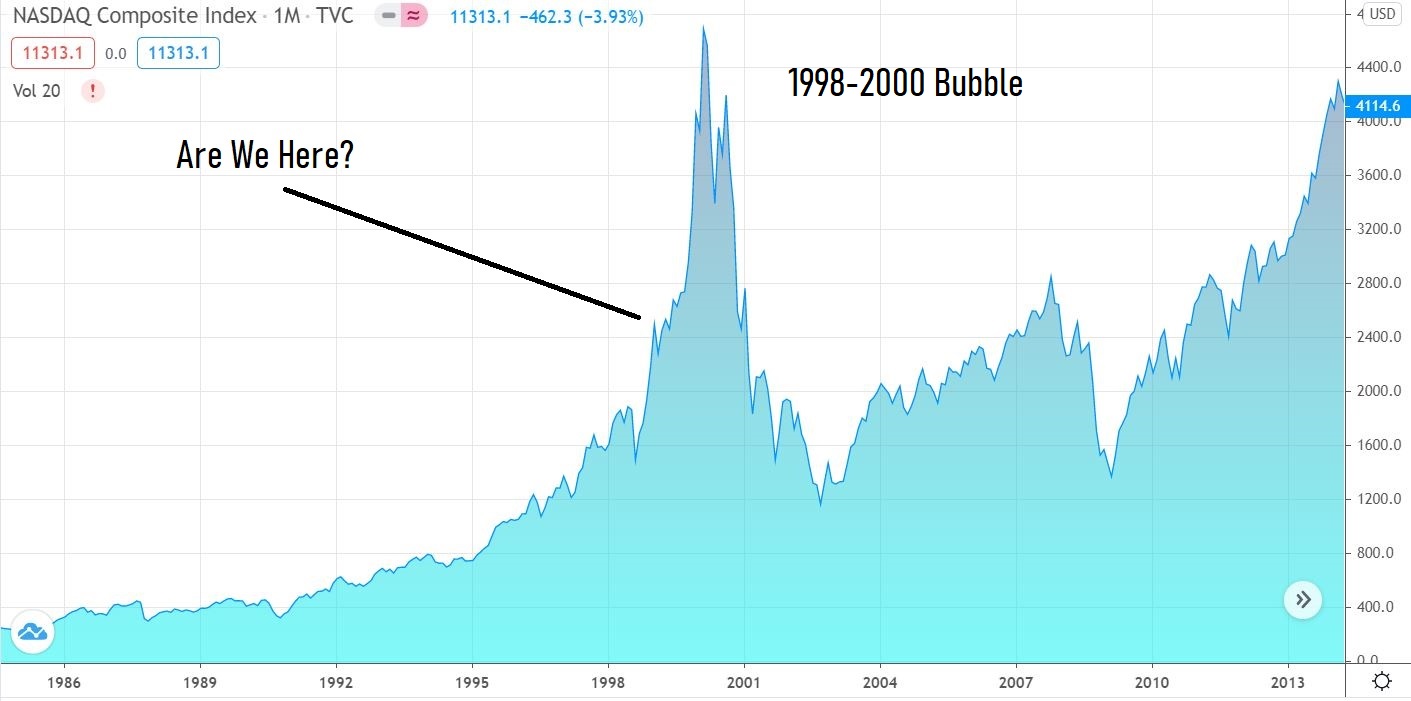

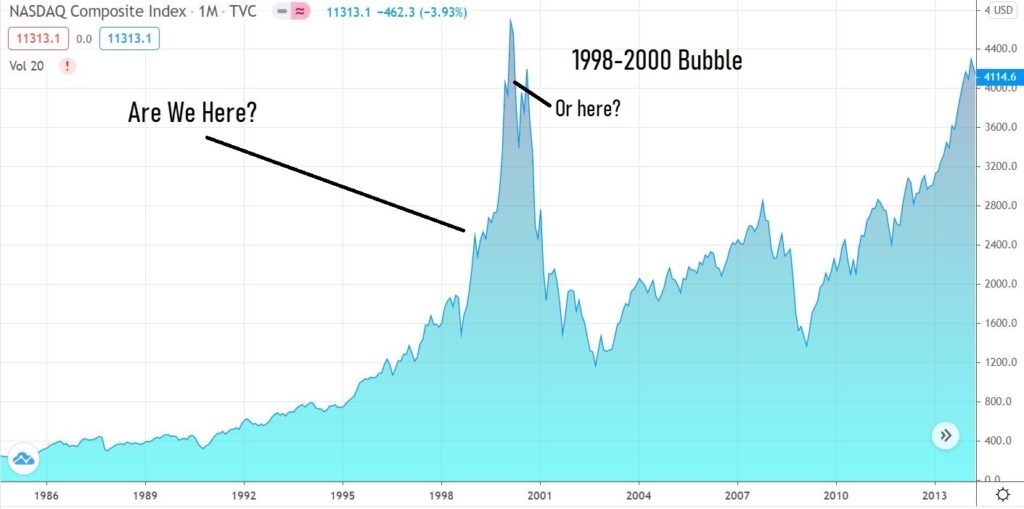

COME BACK IN A YEAR TO REVIEW THIS CHART!

DID YOU PLAY THE END OF THE 1999 BUBBLE WITH ANY SUCCESS?

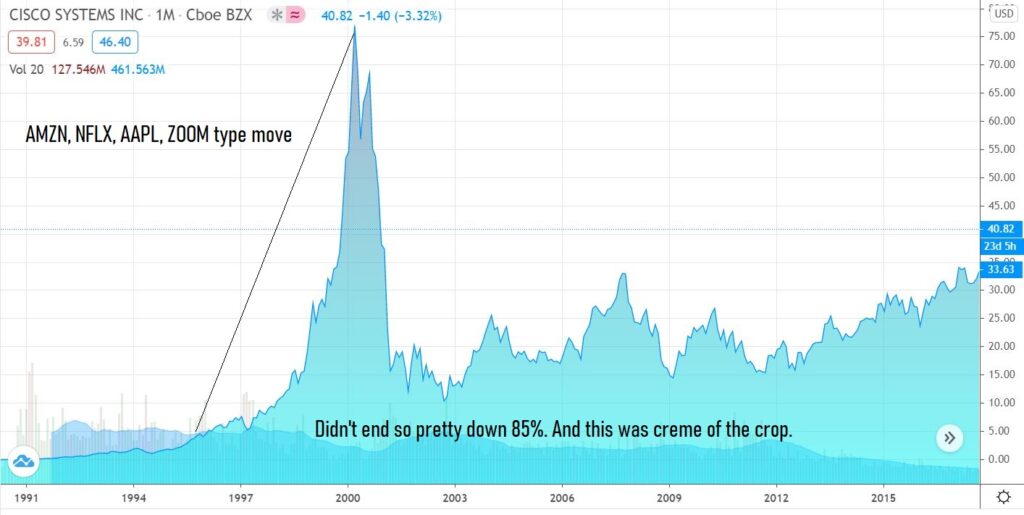

AND IF YOU THINK “THAT’S JUST THE MARKET” – TLSA, FLEX, AMZN WON’T GET HITS AS HARD, THINK AGAIN.

CISCO WAS A CREME OF THE CROP INSTITUTIONAL HOLDING IN 2000 DIP.

ANYTHING LOOK ODDLY FAMILIAR TO CISCO BELOW?

“We think this is a big, big – one of the biggest of all time – houses of cards that is getting ready to fold,” said David Trainer. Tesla Could Be the Most Dangerous Stock on Wall Street. CNBC

A LESS VENTURESOME PETER SCHIFF SUGGESTS DON’T WAIT FOR THE BUBBLE TO POP.

GET OUT NOW!!

BEST PRIMER ON WHAT TO EXPECT IN THE ECONOMY AHEAD

Dow at 26,000, Gold at $1,800, and Silver at $19 at time of above interview.

*Oh boy. $250 trillion is almost three times global economic output and equates to about $32,500 for every man, woman, and child on earth.