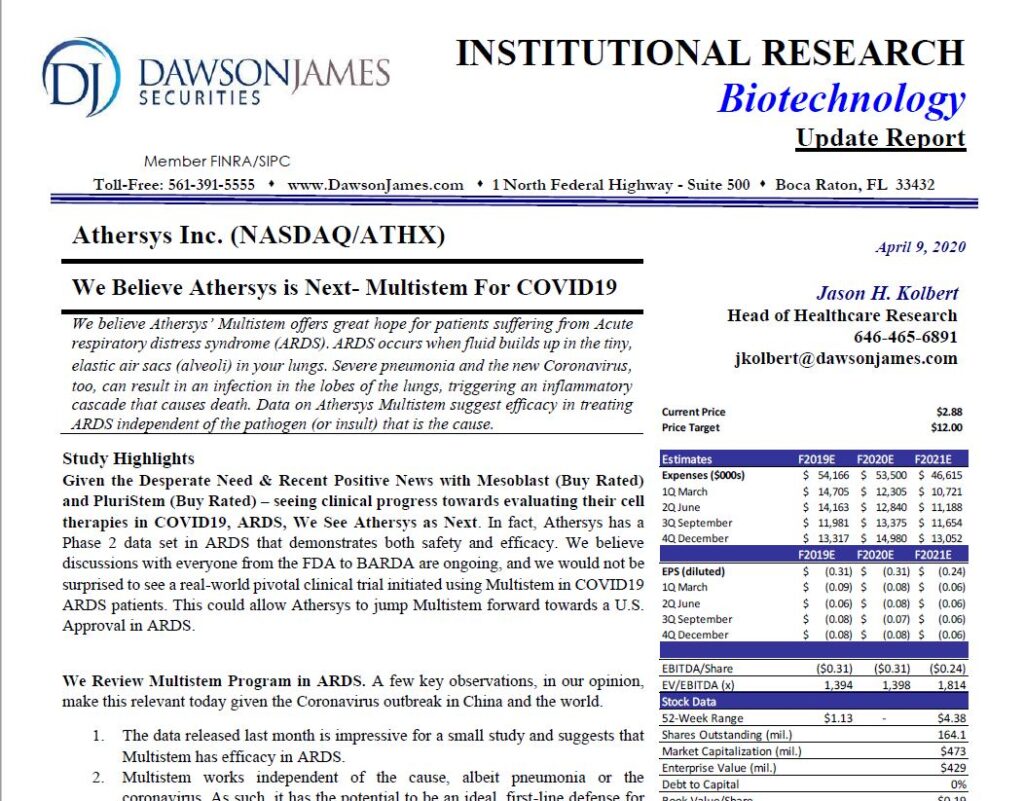

A major Wall Street firm that specializes in Bio and Medtech Companies has a $12 price target out on Athersys from one of its top-ranked analyst Jason Kolbert. And no, we’re still not sure how to pronounce Athersys! But we do know how to say “Who’s better than us, lol?”

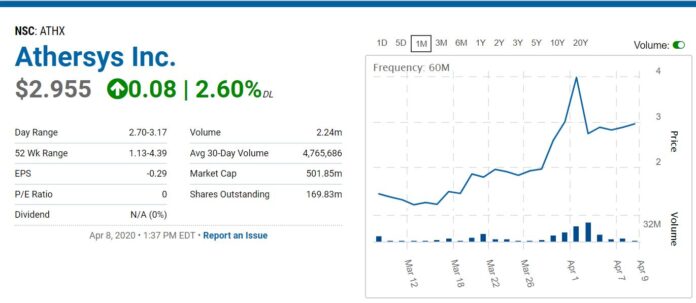

Athersys had gained $188 million in shareholder value since we added it to the Watch List on March 20th. Just doing our part. This is like the Dotcom days, but we all know how that ended – but hey, make hay while the social distancing lines are the longest!

RELATED: Let’s be ‘Corona Clever’ and Catch one Before the POP. Athersys (ATHX) $1.85

Athersys platform is called “Multistem.” Cells obtained from a single donor undergo no genetic manipulation or modification and may be used to produce banks yielding hundreds of thousands to millions of doses of the MultiStem product – an amount that substantially exceeds other unmodified stem cells.

Select excerpts from the Dawson James report:

“We believe discussions with everyone from the FDA to BARDA are ongoing, and we would not be surprised to see a real-world pivotal clinical trial initiated using Multistem in COVID19 ARDS patients. This could allow Athersys to jump Multistem forward towards a U.S. Approval in ARDS.”

(With 164 million shares outstanding, Athersys has a market valuation of $473 million.)

“The data released last month is impressive for a small study and suggests that Multistem has efficacy in ARDS.”

“Multistem works independent of the cause, albeit pneumonia or the coronavirus. As such, it has the potential to be an ideal, first-line defense for patients in respiratory distress.”

(Jason Kolbert Analyst and Senior Director of Research, spent the last year as a senior biotechnology analyst at HC Wainwright and previously seven years at the Maxim group, where he was an Executive Managing Director and the Head of Healthcare at the firm. During this period Jason and his team covered 80 names across the healthcare vertical. Jason’s Wall Street career began with seven years at Citi Group followed by several years on the buy side as a portfolio manager with the Susquehanna International Group. Mr. Kolbert returned to his sell-side role after spending time in Industry as the head of business development for a public cell therapy company. Mr. Kolbert holds an undergraduate degree from the State University of New York in Chemistry and a Master’s in Business Administration from the University of New Haven.)

Get Updates on Athersys and our Superbug News Here

UNRELATED: Our Favorite CoronaVirus Story.