IPO Tumbles in Aftermarket, from $12 underwritten by Oppenheimer, BTIG and Ladenburg Thalmann, to a low of $3 in six months.

$40 million was raised valuing the Company at $137 million. At $3 the Company was valued at $33 million, making aftermarket performance look like a bride left at the altar, shortly after vows were exchanged!

We met with management at Company sponsored dinner earlier in the week and we came away extremely enthusiastic about the Company’s prospects – and with the share price remaining near 1/3rd of the IPO price – the stars may be aligning here. Three analysts are covering the stock (the underwriters of course) and all have price targets over $20 per share – which is a nice 400% potential increase from these levels.

Being thinly traded, a price recovery could come quick on further positive news.

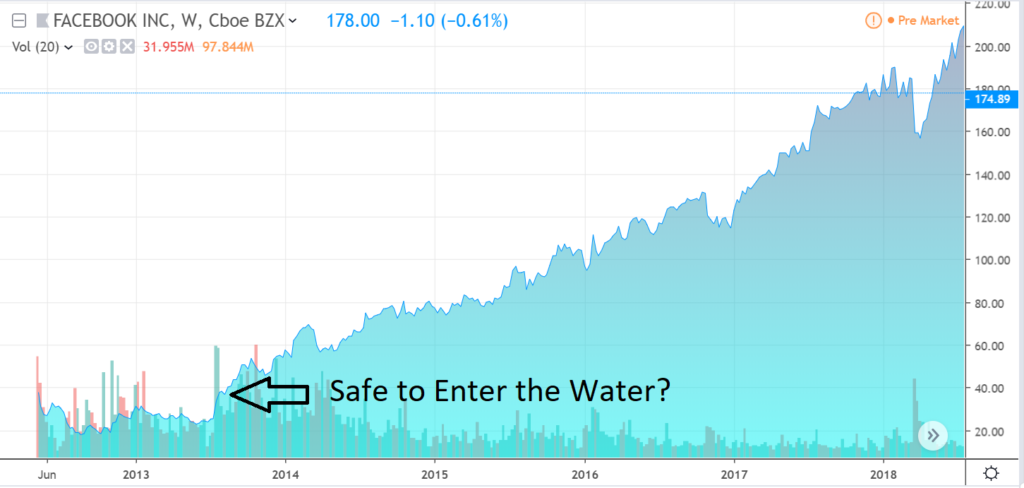

In situations like this, it is typically best not to play hero, and wait until the share price steadies and then starts to move higher – because ‘all-time’ lows can get lower. Think of Facebook’s (FB) post IPO tumble. While we don’t issue price targets, Vaccinex looks like it’s steadied and beginning a journey to ‘higher.”

FACEBOOK POST IPO TRADING

BUYING AT $30 WAS A SAFER BET THAN AT $18.

Vaccinex specializes in targeted biotherapeutics to trade serious diseases and ones with unmet needs including cancer, neurodegenerative diseases, and autoimmune disorders. The company’s key product candidate is VX15, for the treatment of non-small cell lung cancer, or NSCLC, osteosarcoma, melanoma and Huntington’s disease.

(Breaking news: Dyadic (DYAI) Uplists to NASDAQ!)

The CEO Maurice Zauderer did an excellent job at explaining the technology in plain English at the investor meeting, to an audience who have large portfolios but do have scientific backgrounds. While we shy away from science (it’s just too complicated and we prefer to instead look at who’s involved and news on progress) here are some technology ‘basics.’

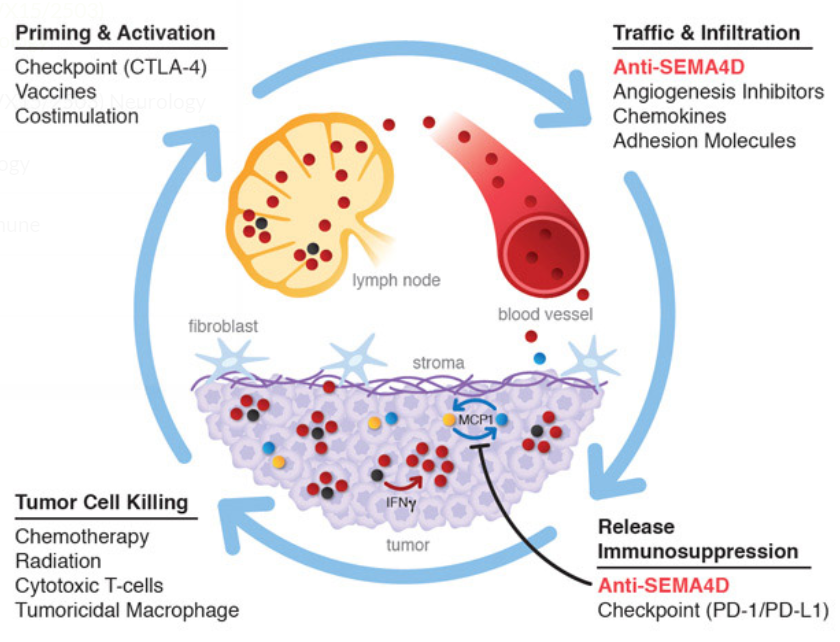

VX15 is an antibody that binds to Semaphorin 4D, a protein produced by immune cells, particularly T-cells. It interacts with a number of proteins in a range of processes including the maturation, movement, and survival of cells in the immune system, nervous system, and blood-vessel system.

High levels of Semaphorin in a tumor can prevent immune cells from entering the tumor site, reducing the body’s ability to fight cancer.

VX15 is an antibody that binds to Semaphorin preventing it from interacting with its receptors. Blocking SEMA4D in tumor cells slows cancer’s growth and prevents it from spreading to other tissue. VX15 also allows immune cells to enter the tumor to kill the cells there.

Okay? Done with the science. Let’s look at the chart.

NEWS.

The share price may have marked a bottom and reacted favorably (up 50%) on news that came out on April 1st (press released the 4th), from the American Association for Cancer Research annual meeting. Oh and only 18,000 shares traded that day. As we said earlier, this could run fast on good news.

With the share price back to pre-AACR news, this may be a good entry point for speculative investors.

WHO’S INVOLVED.

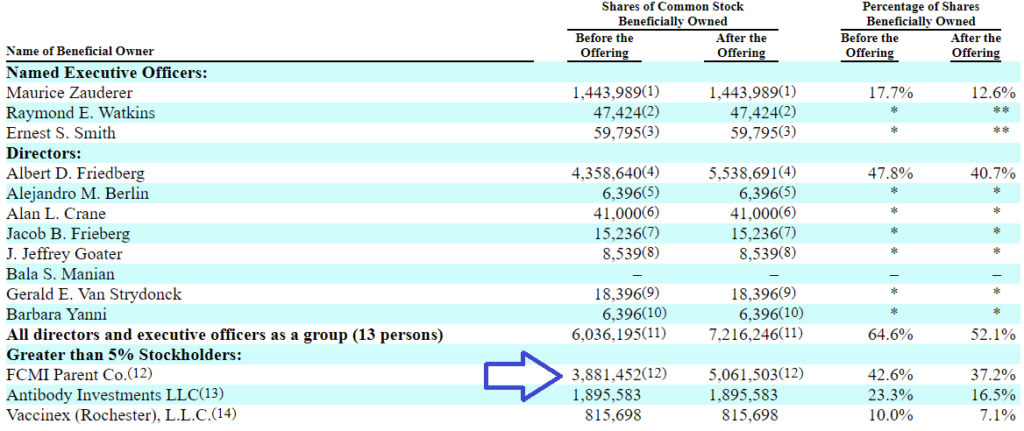

12: Includes 967,983 shares issuable upon the exchange of limited partnership interests in Vaccinex Products held by FCMI Financial, a subsidiary of FCMI Parent. Amount after the offering includes 1,180,051 shares issuable upon the exchange of partnership interests in VX3. Mr. Friedberg is the majority owner, a director and the president of FCMI Parent and shares voting and investment power over the shares held by FCMI Parent. The address for FCMI Parent is 181 Bay Street, Suite 250, Toronto, Ontario Canada M5J 2T3.

FCMI Parent Co holdings (partial).

FCMI Google search.

More details to come, please start your due diligence efforts here reading the IPO prospectus. If we get our hands on the research reports (which we nonetheless assume will be overly technical) we will post them or link to them from our site.

Vaccinex press release disclaimers.

Forward-Looking Statements

To the extent that statements contained in this press release are not descriptions of historical facts regarding Vaccinex, Inc. (“Vaccinex,” “we,” “us,” or “our”), they are forward-looking statements reflecting management’s current beliefs and expectations. Words such as “may,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “potential,” “advance,” and similar expressions or their negatives (as well as other words and expressions referencing future events, conditions, or circumstances) are intended to identify forward-looking statements. Forward-looking statements may involve substantial risks and uncertainties that could cause our research and pre-clinical development programs, clinical development programs, future results, performance, or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, uncertainties inherent in the execution, cost and completion of preclinical and clinical trials, uncertainties related to regulatory approval, risks related to our dependence on our lead product candidate pepinemab (VX15/2503), and other matters that could affect our development plans or the commercial potential of our product candidates. Except as required by law, we assume no obligation to update these forward-looking statements. For a further discussion of these and other factors that could cause future results to differ materially from any forward-looking statement, see the section titled “Risk Factors” in our periodic reports filed with the Securities and Exchange Commission (“SEC”) and the other risks and uncertainties described in our prospectus for our initial public offering dated August 9, 2018, filed with the SEC pursuant to Rule 424(b) under the Securities Act of 1933, as amended.

(Not a client, yet.)