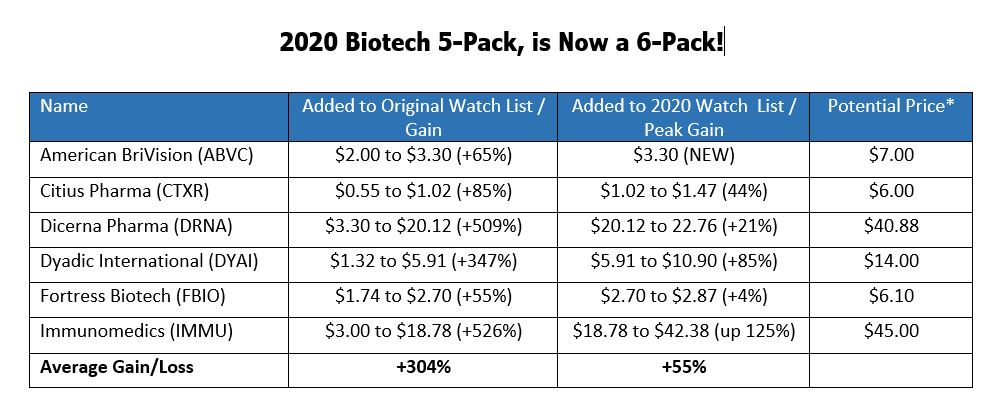

Adding to Our 2020 Biotech 5-Pack, 5 Stocks We Expect to Double in 2020

To Put It Mildly, We Are Absolutely Amazed With Our 2020, 5-Pack – Especially In The Light Of – Well Everything.

We originally wanted to issue a 6-Pack of stocks we expected** to double in 2020 (pre-COVID-19) for clever marketing purposes last January 23rd, but we just could not find that sixth candidate. Until today that is. And now we have the coveted ‘six-pack’ with the addition of American BriVision (ABVC)!

The story, for now is a revolutionary eye fluid substitute called Vitargus, that replaces the natural eye-fluid which must be replaced when undergoing surgery.

Called a Vitreous substitute – this is probably one of the most exciting medical technologies we ever have come across, in that it appears to perform superior to the standard of care (air, octa fluoropropane, sulfur hexafluoride, silicone oil) which all have disadvantages and often lead to complications and additional surgeries. A Vitrectomy is a surgery where the gel that fills the eye cavity is removed and replaced.

SUMMARY:

Where it gets interesting, is in knowing that there were approximately 1.9 million applicable eye surgeries performed in 2019, which is expected to grow to 4.0 million by 2030.

The average cost of the surgery is $14,230 – so this is a massive multi-billion market.

While we cannot accurately predict where Vitargus will be priced if approved, we do know a competing product from Alcon called Perfluoron sells for as much as $2,500. Perflouron is a Perfluorocarbon Liquid (see competition above) and has significant long-term toxicity issues.

This would indicate an addressable market exceeding $4 billion.

Vitargus in early ‘in-human’ studies has been shown to be well-tolerated and effective. No conclusive evidence of toxicity (including elevated intra-ocular pressure and keratopathy) was observed. And it showed a statistically significant improvement from baseline in best-corrected visual acuity. In short, a better product than what is currently available on the market.

While the ‘in-human’ trial was small, the most important thing to remember that once past the point of human trials (with any drug or device in the FDA approval process) lighting can strike. Our definition of lightning is where a major-pharma which has read the study, decides to enter into the picture by partnering with American BriVison to complete the required trail.

Where a lot of medical technology investors make a mistake, is in presuming the incubator of the technology will need to raise the capital to bring the trial to completion. They assume the company will need to fully complete the trial in the chart below from start to end – before any action can happen in the company stock price. For speculative medical technology investors, this can be a huge mistake.

An announcement of a partnership can happen, and frequently does, happen anywhere along the above timeline.

Of course, investors should be aware of where the company is in the timeline and ABVC shows a detailed roadmap (below) of where they are in the process.

A partner can show up tomorrow, or after the first patient, first visit in Australia/New Zealand, or after the first patient, first visit in Thailand.

We simply don’t know when (or if) a partner will show up. However big pharma understands the further the company gets along the process on their own, the more expensive the partnership will become in terms of negotiation licensing rights. They also know someone else could step up first.

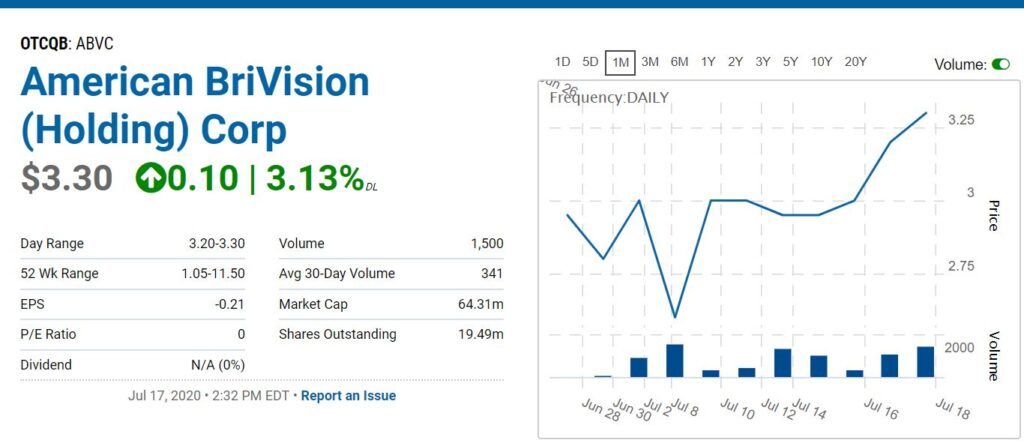

What we do know is with a market valuation of only $70 million (with 19 million shares outstanding), versus an addressable market of $4 billion, news of a partnership will have a dramatic effect on the share price. This we can rest assured of.

Depending on the name of the partner (say Alcon vs. a lesser-known pharma) we would not surprised to see a market valuation above $150 million – which is where we came up with our $7 per share price potential.

(Client, see report for full disclosure and disclaimer details.)

#ABVC, $ABVC